Business Insurance Levantam: Protecting Your Enterprise

Starting a business is a courageous endeavor, and in the bustling marketplace of Levantam, it’s crucial to safeguard your enterprise against unforeseen challenges.

Business insurance, often overlooked, plays a pivotal role in mitigating risks and ensuring the stability of your company.

In this comprehensive guide, we’ll delve into the world of business insurance in Levantam, exploring its types, importance, selection criteria, cost-saving strategies, and much more.

Table of Contents

ToggleImportance of Business Insurance:

Generally speaking, you should obtain insurance against risks that you couldn’t afford to take on yourself.

This policy provides financial protection against personal harm, property damage, medical expenditures, libel, slander, defending lawsuits, and settlement bonds or judgments.

Starting and running a business is similar to fulfilling your aspirations. But what if something unexpected happens, such as a violent storm hitting your ship?

Business insurance acts as a life jacket for your company, always ready to help when things go wrong. It keeps your business afloat, allowing you to pursue your dreams even when faced with difficulties.

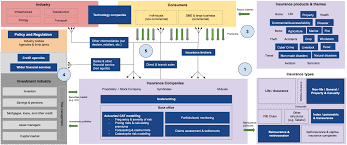

How Does Business Insurance Levantam Change the Insurance Landscape?

Commercial Insurance Levantam adapts to its surroundings with ease, much like a chameleon. It rejects traditional insurance firms’ one-size-fits-all strategy.

Instead, it creates insurance that is specifically customized to your company’s needs. You receive the protection you require, with no extraneous coverage.

Levantam’s Business Insurance: A Comprehensive Review:

Consider Commercial Insurance. Levantam is your enterprise’s ever-vigilant guardian angel. When adversity strikes, this guardian angel steps in to assist you in getting back on your feet.

Consider it like having an astute friend who is well-versed in insurance by your side, ready to keep you safe.

Differentiating Business Insurance Levantam from Traditional Insurance:

Conventional insurance can feel like trying to squeeze into ill-fitting shoes at times. It does not genuinely meet your requirements.

Business Insurance Levantam, on the other hand, is analogous to a pair of custom-made shoes. It’s snug, cozy, and always ready to support you.

Benefits of Adopting This Innovative Insurance Approach:

Choosing Business Insurance Levantam has several advantages. First and foremost, it is cost-effective, ensuring that you can secure your company without breaking the bank.

It also streamlines the insurance process. There are no complicated forms or baffling lingo here—just plain, accessible help when you need it the most.

Customized Insurance Coverage to Meet Your Company’s Needs:

Your company is as one-of-a-kind as you are. Commercial Insurance Levantam is not a one-size-fits-all solution.

Instead, it tailors coverage to your company’s exact needs. It’s like having a properly tailored garment that’s neither too tight nor too loose.

Insurance Procedures That Have Been Simplified and Optimised:

Traditional insurance coverage might be compared to putting together a complicated puzzle with missing pieces.

It’s like putting together a simple puzzle with Business Insurance Levantam—easy and stress-free. There are no headaches or long phone calls; everything happens smoothly.

Levantam Business Insurance Claims Handling Made Simple:

Consider how time-consuming it would be to replace a flat tire on your bicycle. That is not the case with Levantam Business Insurance.

In the event of an issue, it’s as if you have a pit stop staff ready to get you back on the road as soon as possible.

Features and Insurance Options:

Commercial Insurance Levantam offers a wide range of insurance options, similar to a menu at your favorite restaurant.

You have complete control over anything you want. Levantam provides the best insurance coverage, whether you need it for accidents, property damage, or online vulnerabilities.

Levantam assists entrepreneurs with business insurance:

Starting a business can often feel like scaling a mountain. There are peaks and dips, as well as the occasional stumbling block.

Business Insurance Levantam acts as a safety net, keeping you from falling too far and easing your recovery.

Increasing Peace of Mind and Security:

Running a business may be extremely demanding, equivalent to juggling multiple balls at the same time.

Commercial Insurance Levantam acts as a safety net, allowing you to concentrate on the juggling act without fear of dropping the balls.

Enabling entrepreneurs to focus on their core business:

Consider competing in a race while carrying a hefty backpack. Business insurance relieves you of the burden of carrying a heavy bag, allowing you to sprint quicker toward your objectives.

Encouragement of Entrepreneurship and Innovation:

Starting a business is akin to venturing into new territory. It’s thrilling, but the unknowns can be frightening. Business Insurance Levantam helps the water seem less threatening.

It acts as a map, pointing you in the proper direction and enhancing your chances of discovering novel avenues and producing innovative discoveries.

Levantam Business Insurance’s Claims Procedure: Don’t ignore 3rd step

Submitting a claim to Business Insurance Levantam is as simple as texting a friend:

1. Report the incident: Inform Levantam if something goes wrong.

2. Provide specifics: Share images or describe the problem to convey what happened.

3. Inspection: The professionals at Levantam investigate the matter and make a decision.

4. Prompt assistance: If your claim is authorized, Levantam responds quickly to your needs, much like a supporting buddy by your side.

Claims Processing is Simple and Quick:

Levantam acts as your personal guide through the maze, making sure you don’t get lost and assisting you in finding your way.

If you have any questions or need assistance, their helpful team is here to help, so you don’t have to go it alone.

Obtaining Levantam Commercial Insurance: 4 Easy steps!

Getting insurance from Business Insurance Levantam is as simple as buying pizza online:

1. Begin the conversation: Begin by discussing your requirements with a Levantam representative. They’ll pay close attention.

2. Fill out a form: Just as you would for pizza delivery, submit important business information.

3. You have complete control: Levantam’s experts will evaluate your data and decide the best coverage for you.

4. Securing coverage: Once everything is in order, you’ll obtain your insurance, much like purchasing a ticket to your favorite performance.

Policy Cost Estimation:

Are you concerned about the cost? Not to worry. Levantam offers appealing deals that are affordable.

The cost will vary based on the sort of insurance you choose and the size of your firm, but it will be reasonable.

3 Pro Business Owners’ Tips Insurance Preparation:

Consider the following simple steps before diving into the world of insurance:

1. Consider hazards: Consider potential risks that may affect your business. It’s similar to looking both ways before crossing the street—being cautious keeps you safe.

2. Budgeting: Just as you manage your budget, consider how much money you can set aside for insurance.

3. Seek advice: If you’re unsure about your requirements, don’t be afraid to consult with Levantam or an insurance specialist. Consider it like asking a friend for directions when you’re lost.

Conclusion:

In conclusion, business insurance in Levantam is not merely an option; it is a necessity. By securing the right insurance coverage, you can safeguard your assets, protect your employees, and ensure your business’s longevity.

Don’t leave your enterprise vulnerable to unforeseen events; take the necessary steps to protect it with comprehensive business insurance.

FAQ’s:

Q1. How does commercial insurance work?

Business insurance protects against losses caused by unforeseeable events such as lawsuits, accidents, or natural catastrophes, among others.

General liability insurance, professional liability insurance, property insurance, and home-based company insurance are all examples of commercial insurance products.

Q2. What is the importance of business insurance Levantam?

Business insurance Levantam is vital because it shields your business from unexpected financial burdens.

Whether it’s property damage, legal issues, or employee injuries, having the right insurance ensures that your business remains resilient.

Q3. How can I determine the right coverage for my business?

To choose the right coverage, assess your business needs and risks. Consult with an insurance expert who can help you tailor a policy that suits your specific requirements.

Q4. What factors affect business insurance premiums?

Several factors influence your insurance premiums, including your industry, the location of your business, the size of your workforce, and your claims history.

Q5. Are there any legal requirements for business insurance in Levantam?

Certain types of insurance, such as workers’ compensation, are mandatory in Levantam.

The specific requirements may vary based on your business size and type.

You May Also Like

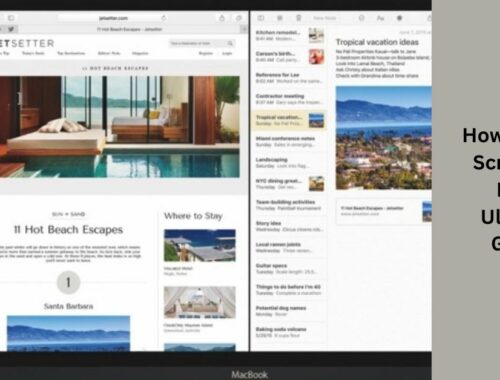

How To Split Screen On Mac – Ultimate Guide!

March 7, 2024

Insurance For Car In Clovis Otosigna – Let’s Explore It Out!

October 27, 2023