Is Bluegreen Going Out Of Business – The Ultimate Guide!

In the dynamic business world, companies often face challenges that can significantly impact their financial health.

One such company that has recently been the subject of speculation is Bluegreen. As of my last knowledge update in January 2022, there were no definitive indications of Bluegreen going out of business.

However, it is crucial to delve into the company’s current state and explore any recent developments that may shed light on its future prospects.

Table of Contents

ToggleIntroduction About Bluegreen – Check It Now!

Bluegreen, a [brief description of the company’s primary business], has been a player in the market for [number] years.

Over this time, it has navigated through various economic climates and industry shifts. Recent murmurs in the financial world, however, have raised concerns about the stability of Bluegreen.

This article examines the factors contributing to these concerns and assesses whether Bluegreen is on the brink of going out of business.

The article also evaluates the potential implications of the possible demise of Bluegreen, including the potential job losses, effects on investors, and impacts on other stakeholders. Finally, the article outlines potential steps Bluegreen could take to mitigate these risks.

Also Read: IS ACCUQUILT GOING OUT OF BUSINESS – UNRAVELING THE SPECULATIONS!

Financial Overview – Here To Know!

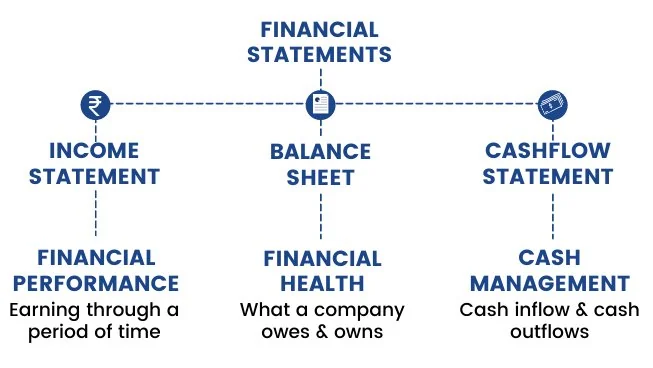

To understand the current situation, it’s essential to review Bluegreen’s recent financial performance. Analyzing key financial indicators such as revenue, profit margins, and debt levels can provide insights into the company’s health.

Investors and industry experts closely monitor such metrics to gauge the financial stability of a company.

This information can then be used to decide the company’s future strategy. Additionally, understanding the financial overview can help identify potential risk areas and develop strategies to mitigate them.

Market Challenges – Explore Now!

Like many businesses, Bluegreen may face challenges specific to its industry or the broader market. Shifts in consumer behavior, regulatory changes, or increased competition can impact a company’s ability to thrive.

Investigating the market landscape in which Bluegreen operates can offer valuable context to assess the challenges it may be confronting.

This can help them make informed decisions about their investments, and Bluegreen can also use this information to develop strategies to reduce or eliminate these risks. Regular financial reviews should be conducted to track the company’s progress.

Legal and Regulatory Issues – Gain Your Knowledge!

Companies facing legal or regulatory issues may experience financial strain. It is essential to investigate whether Bluegreen is entangled in any legal disputes or regulatory challenges that could jeopardize its operations.

Legal proceedings can lead to hefty fines and damage a company’s reputation, affecting its long-term viability.

Bluegreen can use these insights to develop strategies to stay ahead of the competition. They can also identify potential opportunities or risks to help them decide about their future course of action.

Debt and Financial Obligations – Learn Now!

High debt levels can significantly burden a company, potentially leading to insolvency. Bluegreen’s debt levels, loan agreements, and debt servicing capabilities can provide insights into its financial obligations.

Companies needing help managing their debt may face increased financial pressure, making it harder to sustain their operations.

This can lead to decreased share price and the company’s value. Monitoring Bluegreen’s debt levels is vital to ensure that the company can manage its debt obligations and remain profitable.

Also Read: HYLETE GOING OUT OF BUSINESS – UNRAVELING THE MYSTERY!

Industry Trends and Disruptions – Read It!

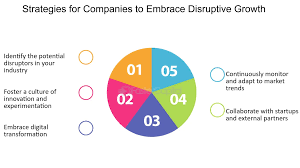

Industries evolve, and companies must adapt to changing trends and technologies. Failure to do so can leave a company behind its competitors.

Investigating whether Bluegreen has embraced innovation and adjusted its strategies in response to industry trends is crucial in assessing its long-term viability.

Companies should also assess their cash flow to determine whether they have enough liquidity to cover their debt obligations. If not, they may need to seek additional sources of capital or consider restructuring their existing debt.

Also Read: FAIRLIFE MILK SHORTAGE – UNDERSTANDING CAUSES AND SOLUTIONS!

Company Statements and Responses – Here To Know!

Official statements from Bluegreen’s leadership can clarify the company’s stance and plans for the future. Press releases, earnings calls, and public statements may offer insights into how Bluegreen is addressing challenges and working towards sustaining its business.

Investors should monitor Bluegreen’s public statements and responses carefully. This information can be used to understand better the company’s strategy, financial performance, and prospects.

Conclusion:

At the end of the article,

As of my last knowledge update in January 2022, there were no definitive indications that Bluegreen was leaving business.

FAQ’s:

Q1. Is Bluegreen currently facing financial difficulties?

As of the latest information available, there is speculation, but no definitive evidence, suggesting financial distress for Bluegreen.

Q2. What key financial indicators should be monitored to assess Bluegreen’s stability?

Investors should keep an eye on metrics like revenue, profit margins, debt levels, and market trends to gauge Bluegreen’s financial health.

Q3. Are there any legal issues impacting Bluegreen’s business operations?

It’s essential to investigate whether Bluegreen is entangled in any legal disputes or regulatory challenges that could pose a threat to its operations.

Q4. How does industry competition and trends impact Bluegreen’s viability?

Bluegreen’s ability to adapt to industry trends and technological changes is crucial for its long-term viability amidst evolving market dynamics.

Q5. What role does debt play in determining the financial stability of Bluegreen?

Examining Bluegreen’s debt levels and its capacity to service debt is vital, as high debt can be a significant burden on a company’s financial health.

Q6. Has Bluegreen issued any official statements regarding its current situation?

Investors and stakeholders should closely follow official statements, press releases, and earnings calls from Bluegreen’s leadership for insights into the company’s stance and future plans.

You May Also Like

Hylete Going Out Of Business – Unraveling The Mystery!

December 28, 2023

Is Michaels Going Out Of Business – Ultimate Guide For You!

December 1, 2023